Discover key trends shaping Bali's 2025 property market—off-plan growth, compact villas, rental shifts, and data-backed insights from REID and SAS.

Which aspects should entrepreneurs be aware of when they employ people in Indonesia? This blog aims to help employers and employees navigate their rights and obligations under Indonesian labour law. It explores the key points to be aware of before employing someone in Indonesia.

If you have questions regarding employing a foreigner in Indonesia, reach out to our legal team for further clarification:

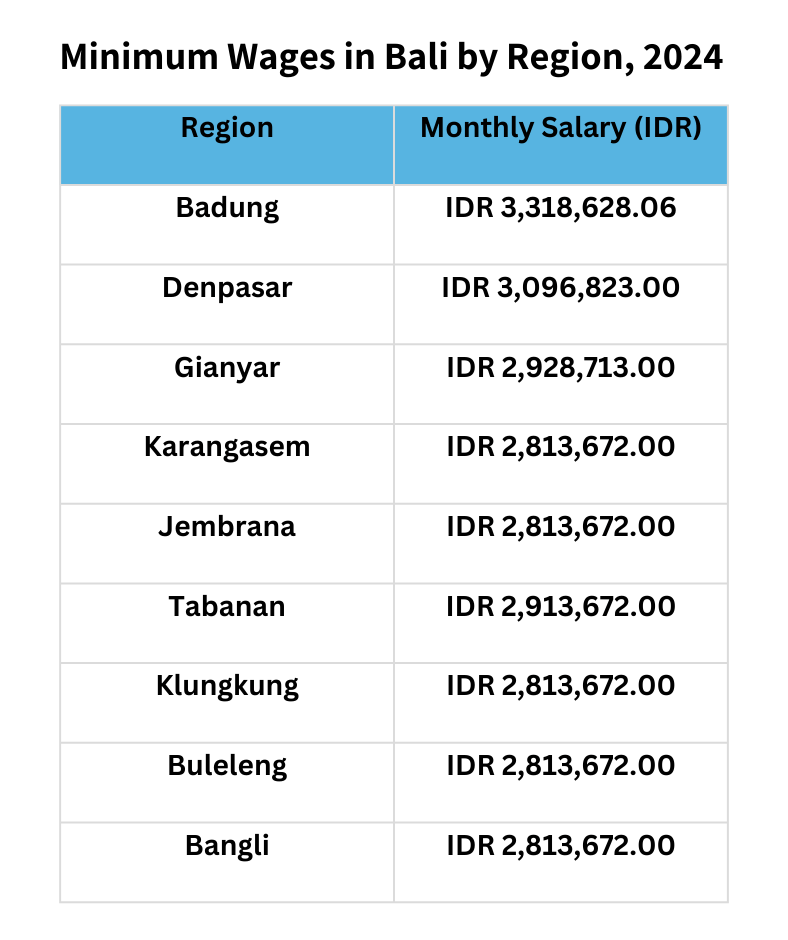

The minimum monthly wage for Indonesian workers in Bali is between IDR 2.8 M - 3.4 M, depending on the regency. Concerning foreign workers, the minimum monthly wage is IDR 8 M. Employers are required to withhold income tax monthly from the salaries and other compensation payable to their employees.

The minimum monthly salary for employees varies, depending on the regency the company is located. The current (2024) minimum wages in Bali are:

New regulations came into effect on 1 January 2024 to simplify the monthly calculation of withholding tax for the above types of income. GR-58 stipulates that the monthly calculation of withholding tax under Article 21 for the months of January to November must be made using an effective tax rate (ETR), and that the annual calculation made in December must always be made using the standard rate of progressive income tax under Article 21 governed by Article 17(1)(a) of the Income Tax Act.

The changes brought about by this regulation may alter the usual amount of employees’ net salary and result in a fluctuation in the payment of less or more tax in December. Employees should be carefully informed to ensure smooth implementation.

For questions or further clarification, our team can provide assistance. Contact us via email at contact@mediumslateblue-hare-720588.hostingersite.com or through WhatsApp +62 821-9495-6032.

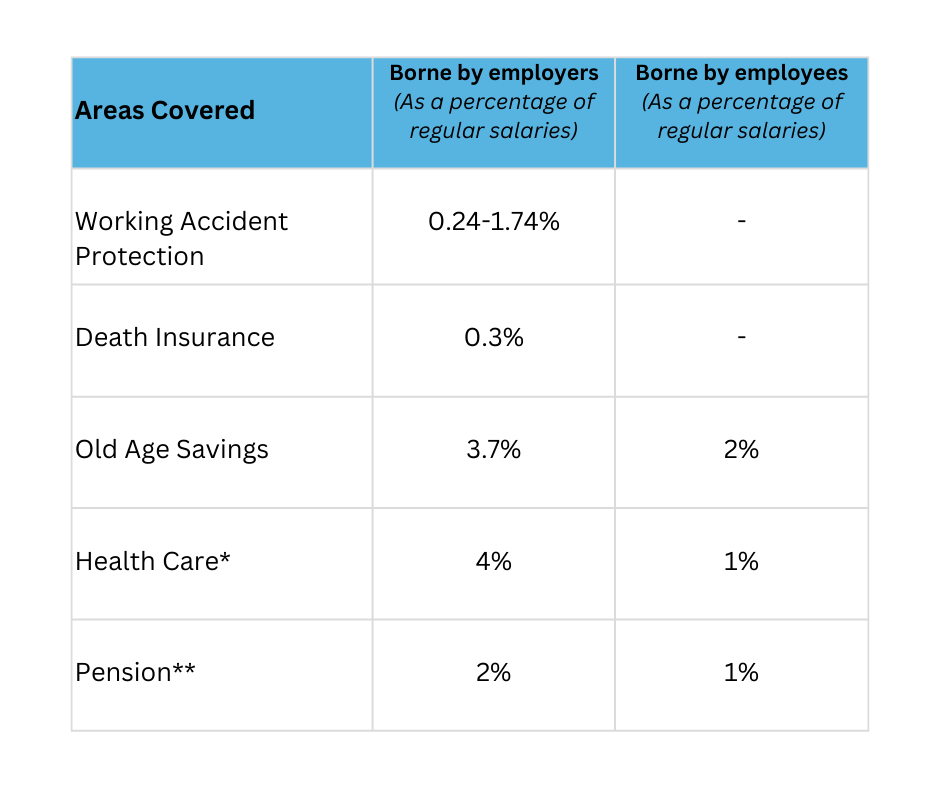

BPJS is Indonesia’s social security system. It consists of two separate administrations. BPJS Kesehatan for health insurance and BPJS Ketenagakerjaan for accidents, pension, death, or life insurance, etc.

Employers are responsible for ensuring that their employees are covered by a social security program (BPJS). Employees’ contributions are collected by the employers through payroll deductions. These must be paid together with the employer’s contributions. The current premium contributions are as follows:

Employee Income Tax and BPJS Handling:

Employee Income Tax as well as BPJS can be handled differently. The company can decide if the Tax will be deducted from the employee’s salary or if the company will pay it. The same applies for the employee part of the BPJS, either it will be deducted from the employee’s salary, or the company bears it.

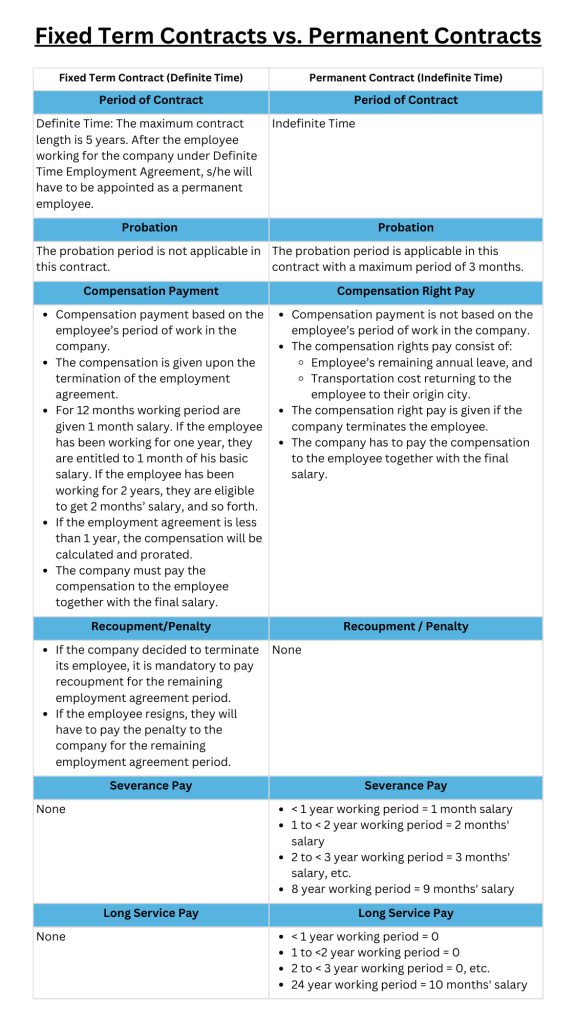

In Indonesia, employment contracts are governed by the Labour Law (Law No. 13 of 2003) and subsequent amendments. There are two main types of employment contract: fixed-term contracts (Perjanjian Kerja Waktu Tertentu or PKWT) and open-ended contracts (Perjanian Kerja Waktu Tidak Tertentu or PKWTT). The table below details the main differences between these two types of contracts:

In general, permanent employees enjoy greater protection, security, and rights under the law than fixed-term employees. This includes health insurance, retirement plans, or bonuses. Nevertheless, fixed-term contracts offer employers the flexibility to manage short-term needs, while open-ended contracts offer a degree of stability to both employers and employees.

Employers must ensure that they comply with regulations on the maximum duration and renewal of fixed-term contracts. Failure to do so may result in the contract being deemed permanent.

SAS specializes in providing comprehensive support and guidance to both employers and employees in Indonesia. With a deep understanding of Indonesian labour laws and regulations, we can help streamline the administrative process of hiring foreign workers.

Furthermore, SAS offers invaluable assistance with compliance matters, such as ensuring adherence to minimum wage requirements, tax regulations, and social security contributions. By leveraging their expertise and resources, employers can navigate these obligations with confidence, knowing that they are in full compliance with Indonesian labour laws.

Contact us today to learn more about our services, via email contact@mediumslateblue-hare-720588.hostingersite.com or via WhatsApp +62 821-9495-6032

Discover key trends shaping Bali's 2025 property market—off-plan growth, compact villas, rental shifts, and data-backed insights from REID and SAS.

Managing payroll in Indonesia is not just about salaries—it is about full compliance. Companies must understand the legal framework, required contributions, and tax deductions that define payroll systems in Indonesia. What Is Basic Salary in Indonesian Payroll? The basic salary is the backbone of any compensation package. By law, it must be at least 75% […]

Discover essential risk prevention tips for expats investing in property in Bali – from legal checks to trusted partnerships.